Fiscal justice

Showing 151 to 180 of 184 results

Assisting Human Rights Council as it assesses rights impacts of austerity

March 1: At UN Human Rights Council, Niko Lusiani supports Guiding Principles for assessing rights impacts of austerity and other economic reform policies.

Tax Justice Network's U.S. tax reform podcast: The killing of the American Dream

27 February: Niko Lusiani discusses the link between U.S. tax reforms and human rights deprivations on Tax Justice Network's latest podcast.

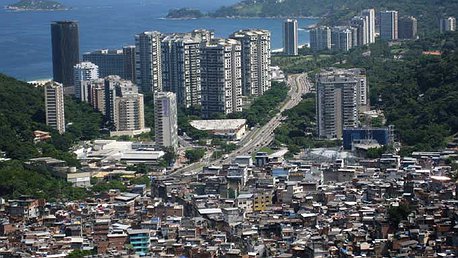

Brazil: Human Rights in Times of Austerity

This video illustrates that advances in tackling poverty and human rights deprivations in Brazil are at risk from a series of harmful and severe austerity measures put in place by the government starting in 2015.

IACHR calls on states to adopt human rights-based fiscal policies to eradicate poverty

29 January: IACHR report acknowledges links between poverty and human rights in the Americas, referencing CESR-led coalition's briefing on relevance of fiscal policies.

"Human Rights in Times of Austerity" covered in thirty Brazilian publications and websites

Media: New factsheet "Human Rights in Times of Austerity" received coverage from at least thirty Brazilian publications and websites in the past month.

Kathryn Sikkink book cites CESR's call for a "tax policy for human rights"

Media: Human rights expert writes that CESR stands out when citing tax havens as a drain on available resources that could provide adequate economic and social rights.

Brasil: direitos humanos em tempos de austeridade

Levantamento realizado pelo Centro para os Direitos Econômicos e Sociais (CESR), INESC e Oxfam Brasil e revela que políticas públicas voltadas à área social tiveram redução de até 83% no orçamento nos últimos três anos. A área que mais perdeu recursos desde 2014 foi a de direitos da juventude, seguida dos programas voltados à segurança alimentar, mudanças climáticas, moradia digna e defesa dos direitos humanos de crianças e adolescentes.

U.S. Tax Plan’s Spiraling Consequences for Human Rights and Poverty – At Home and Abroad

Media: CESR's Niko Lusiani writes in FACTCoalition about CESR bringing the human rights costs of the proposed U.S. tax cuts to the attention of leading UN human rights official Philip Alston now investigating poverty in the country.

U.S. Tax Plan’s Spiraling Consequences for Human Rights and Poverty – At Home and Abroad

CESR's Niko Lusiani writes in FACTCoalition about CESR bringing the human rights costs of the proposed U.S. tax cuts to the attention of leading UN human rights official Philip Alston now investigating poverty in the country.

CESR submission to UN Special Rapporteur warns of proposed U.S. tax plan's ill effects on human rights

CESR submission asserts that pending U.S. tax plan deepens inequalities in the U.S. and beyond.

Tax abuse and human rights: closing the gap between what’s legal and what’s just.

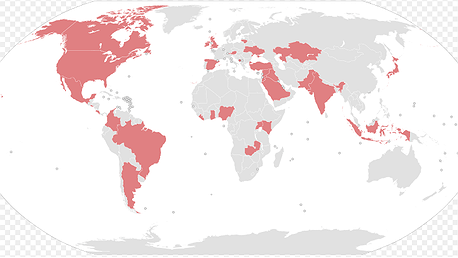

The Paradise Papers prompt a demand for an international convention ending cross-border tax abuse and financial secrecy. A transnational problem, tackling tax abuse requires a concerted global response.

Philip Alston: Tax as a human rights issue

Philip Alston, UN Special Rapporteur on Extreme Poverty and Human Rights and former CESR board chair, addresses the International Strategy Meeting 'Advancing Tax Justice Through Human Rights' in Lima, Peru, 29 April 2015.

Tax competition & avoidance "inconsistent with human rights"

Blog: New CESCR General Comment details governments’ legal duties to prevent and address the adverse impacts of corporate tax avoidance on human rights.

Corporate taxation key to protecting human rights in the global economy

UN expert body takes new steps to prevent corporate tax abuses, but more is needed to ensure companies pay their fair share.

Publications, Reports & Briefings

Política Fiscal y Derechos Humanos en Tiempos de Austeridad

Documento de síntesis: Diálogo auspiciado por la Comisión Interamericana de Derechos Humanos (CIDH) en el marco del 157 periodo de sesiones.

Tax, Inequality & Human Rights

Leading figures from the worlds of human rights and tax justice reflect on the critical importance of bringing these spheres of activism together.

Switzerland's financial secrecy scrutinized under human rights spotlight

UN submission: A coalition of civil society organizations has called on CEDAW to examine the extra-territorial impacts of Switzerland’s financial legislation on women’s rights.

Publications, Reports & Briefings

Redistributing unpaid care work: why tax matters for women’s rights

Tax policies need to focus on women’s human rights and unpaid care work.

Publications, Reports & Briefings, Submissions

Fiscal policy and human rights in the Americas

For the first time, the Inter-American Commission on Human Rights has played host to a thematic hearing specifically focused on fiscal policy and human rights.

Publications, Reports & Briefings

Fiscal Fallacies: 8 Myths about the 'Age of Austerity'

This briefing challenges eight widespread yet misguided perceptions about economic policy in times of crisis, and suggests human rights-centered policy alternatives.

Women's rights and revenues: no gender equality without fiscal justice

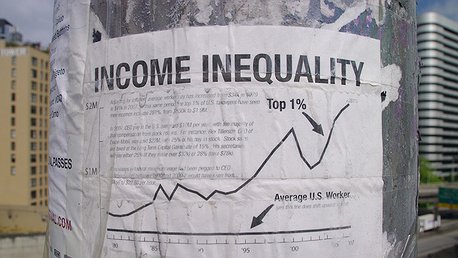

While it is widely accepted that taxation plays a key role in determining income inequality, we are seeing more and more that it dramatically impacts women's equality and human rights as well.

Manuals & Guides, Publications, Reports & Briefings

Accountability for the post-2015 agenda: A proposal for a robust global review mechanism

CESR and its partners have developed a proposal for a robust monitoring mechanism for post-2015 development.

Indicators for a post-2015 fiscal revolution

Working paper: CESR and Christian Aid offer some rights-based proposals for the post-2015 indicator framework.

A missed opportunity for ESCR: Reflections on Egypt's appearance before UPR

CESR's Allison Corkery reflects on the challenges of holding Egypt to account before the UN for its ESCR obligations.

SDGs merely dead letters without fiscal justice and human rights

Unless governments agree to concrete tax and budgetary commitments which ensure robust, equitable and accountable fiscal foundations for sustainable development, the SDGs are likely to fail.

UN Financing Committee hears call for post-2015 fiscal revolution

CESR has urged the UN Committee tasked with devising a post-2015 development financing strategy to tackle the fiscal injustices undermining sustainable development and human rights.

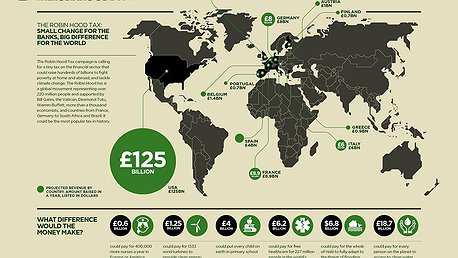

FTT: Robin Hood advocates undeterred by challengers

Blog: Momentum towards the implementation of a financial transactions tax in Europe is facing new obstacles. With success seeming so close yet so far, campaigners are redoubling their efforts.

Europe moves forward on Robin Hood Tax while US balks

The 'Robin Hood Tax' has come one step closer after 11 European countries agreed to move forward with the initiative. Certain key states, including the US, remain opposed, however.

Tax and human rights: 'Robin Hood' no longer just a fairytale

Years of campaigning on the part of social justice organizations looks set to bear fruit in the near future after a group of 10 European countries agreed to move forward in implementing a regional financial transactions tax.

Publications, Reports & Briefings

Financial Transactions Tax: A Human Rights Imperative

The third briefing in the 'Righting Financial Regulation' series provides an overview of how the FTT would work and the benefits it would provide.